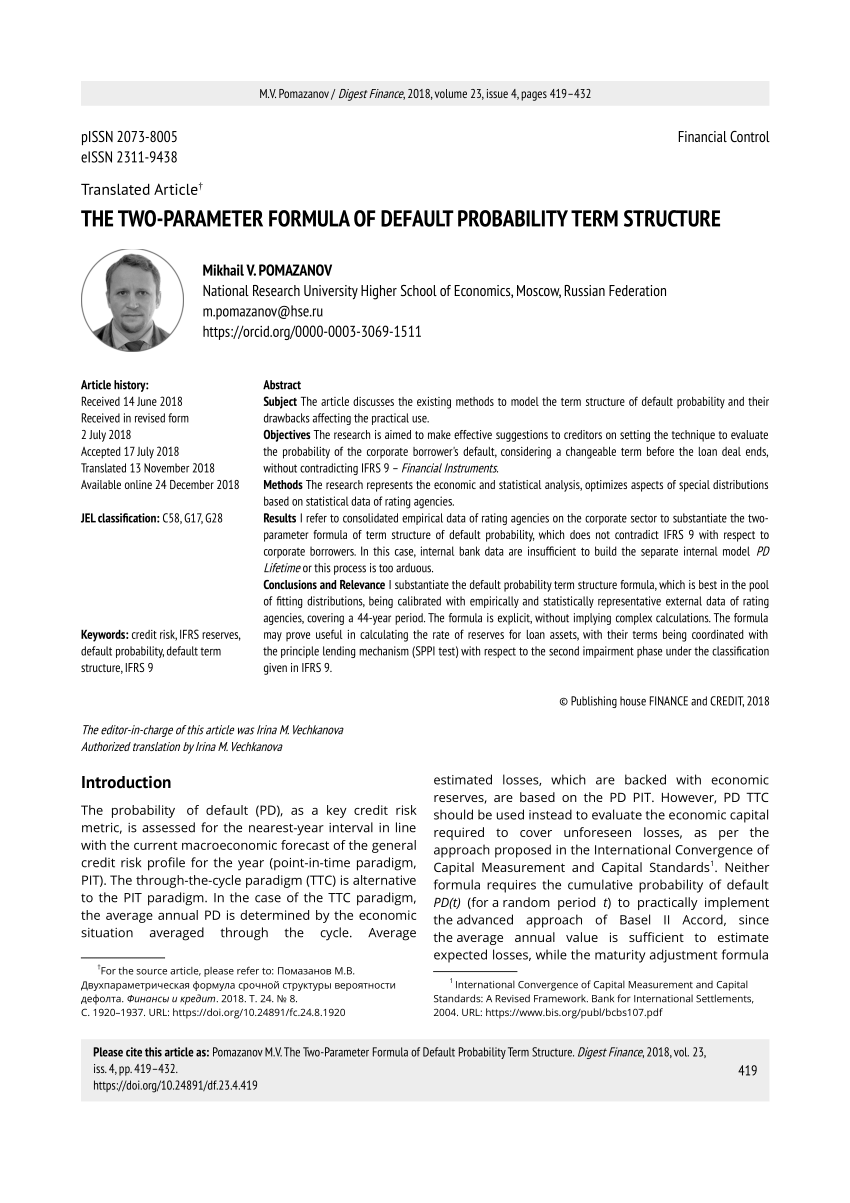

An Introduction to Credit Risk in Banking: BASEL, IFRS9, Pricing, Statistics, Machine Learning — PART 2 | by Willem Pretorius | Mar, 2023 | Medium

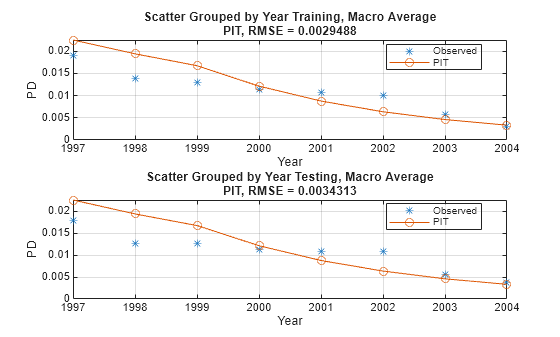

![PDF] Macroeconomic Approach to Point in Time Probability of Default Modeling – IFRS 9 Challenges | Semantic Scholar PDF] Macroeconomic Approach to Point in Time Probability of Default Modeling – IFRS 9 Challenges | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3b50b1fa83e2b6a53df6f1f6c23850e31905d6b0/12-Figure6-1.png)

PDF] Macroeconomic Approach to Point in Time Probability of Default Modeling – IFRS 9 Challenges | Semantic Scholar