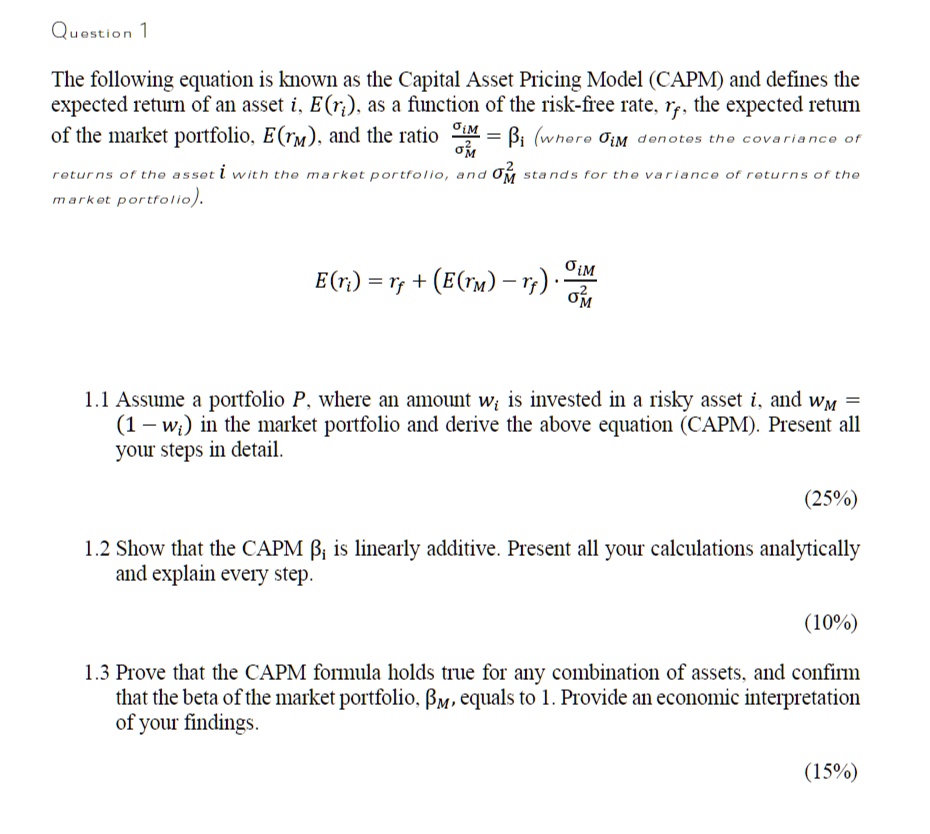

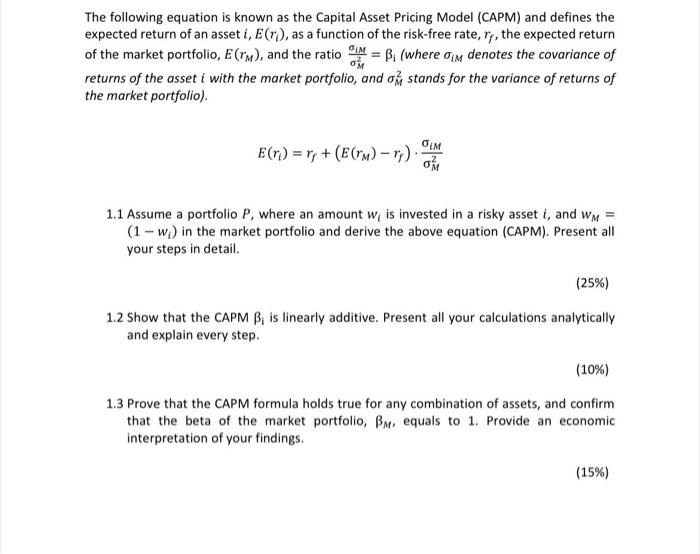

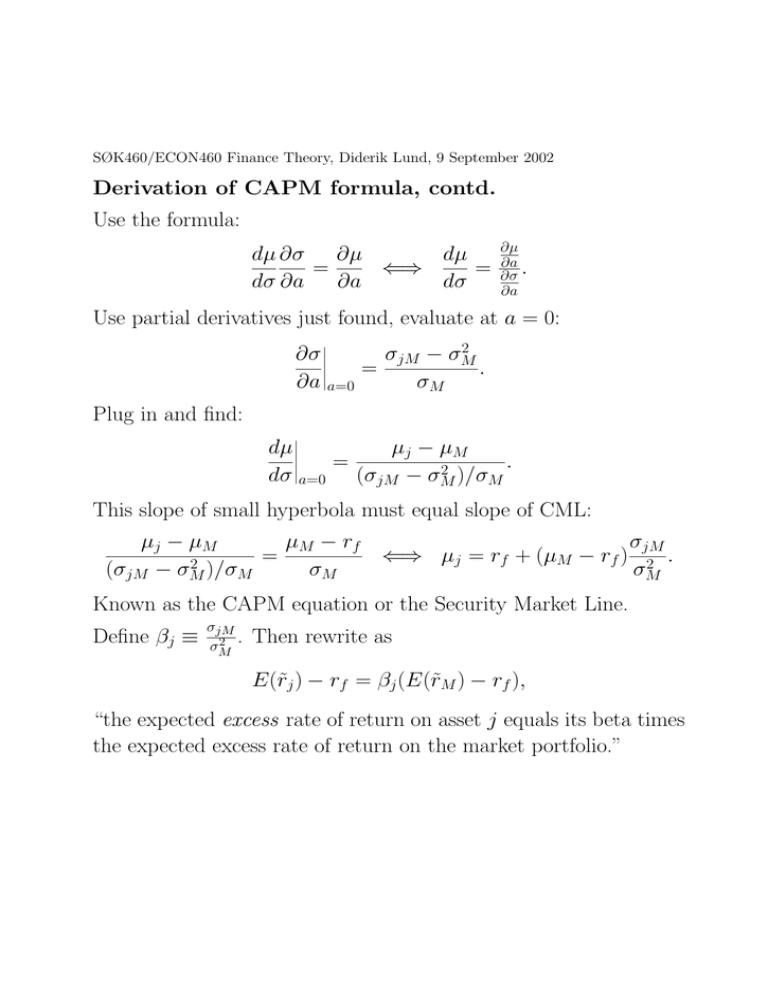

SOLVED: 3. Recall the CAPM formula in a market with N assets: i=r+Bi(M-r)ViE1,...,N OM variance. We want to extend the formula to a portfolio of the N assets with proportion vector given

Lecture 10 The Capital Asset Pricing Model Expectation, variance, standard error (deviation), covariance, and correlation of returns may be based on. - ppt download

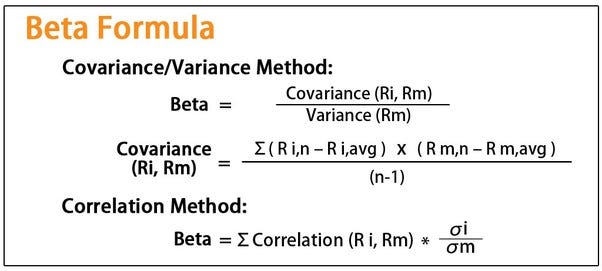

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

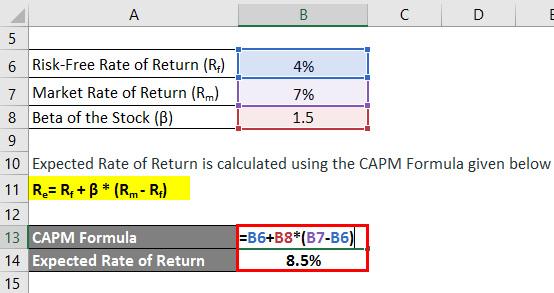

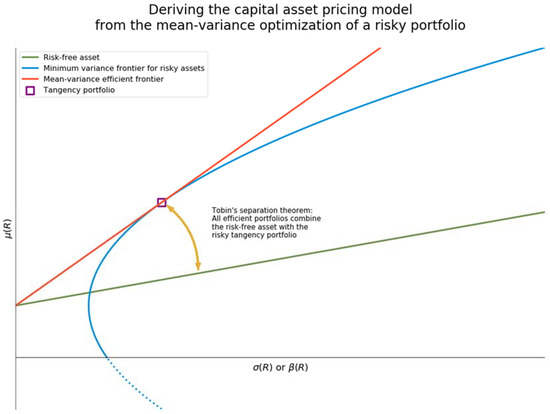

beta - What is the relation between "Capital Market Line" and "Capital Asset Pricing Model (CAPM)"? - Quantitative Finance Stack Exchange